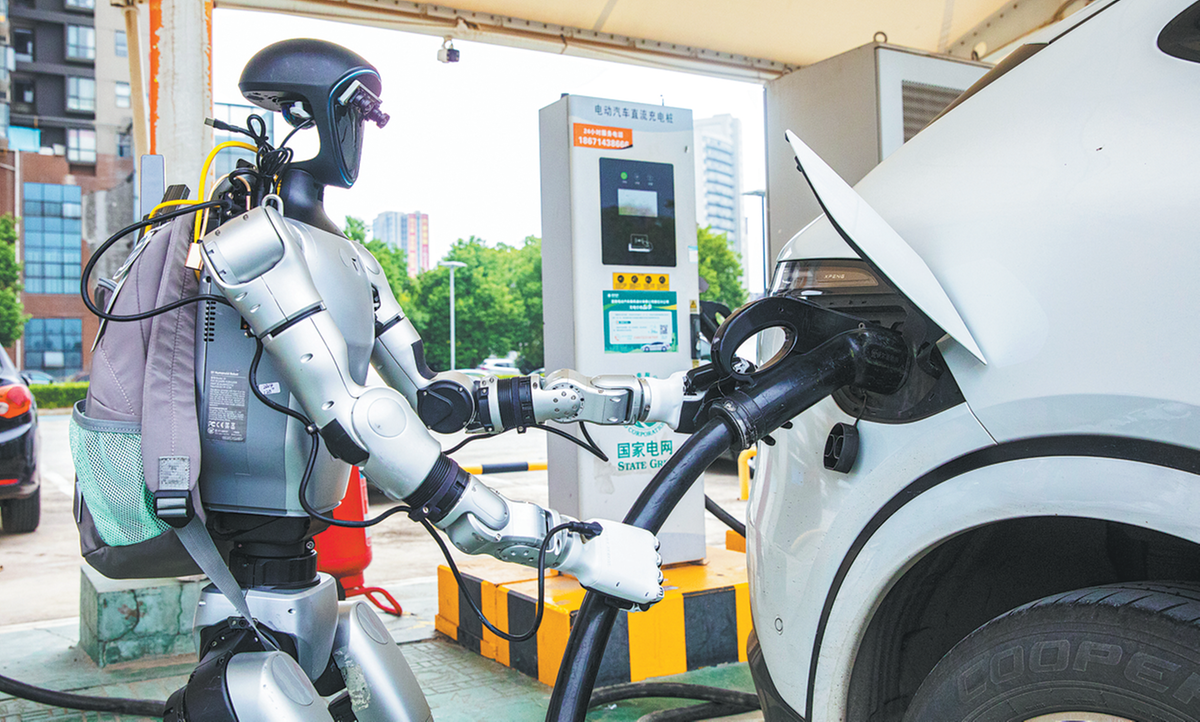

A robot helps to charge a new energy vehicle at a charging station in Huangshi, Hubei province, in September. ZHOU WEI/FOR CHINA DAILY

China has cemented its dominance in the global electric mobility sector, establishing a charging infrastructure network that far outpaces its international peers, said industry experts.

The scale of the rollout is increasingly viewed as a decisive competitive advantage, removing infrastructure bottlenecks to accelerate the mass adoption of new energy vehicles across the world's largest auto market, they said.

Supported by market-driven demand, China's inventory of electric vehicle charging stations reached 18.65 million at the end of October, 54 percent higher compared with the same period of the previous year, according to data released by the National Energy Administration.

Public charging facilities accounted for more than 4.53 million units, a growth rate of 39.5 percent over the previous year. This rapid expansion ensures that public access keeps pace with vehicle adoption rates in densely populated urban areas and along critical transport corridors, it said.

Meanwhile, China's strategic focus is also shifting toward the aggressive development of high-powered, fast-charging capabilities within its vast EV infrastructure network.

This market-driven deployment underscores the maturing of a critical support ecosystem, which is central to Beijing's broader strategy of fostering high-quality economic growth and meeting ambitious environmental sustainability targets.

This move is essential to reduce vehicle downtime and secure efficient operation across commercial fleets, said Lin Boqiang, head of the China Institute for Studies in Energy Policy at Xiamen University.

"Quick turnaround times at charging stops along highways and major corridors are key to mitigating 'range anxiety' and encouraging broader public adoption of electric mobility across China's vast geography," Lin said.

According to the NEA, the growth in private charging infrastructure, which primarily serves residential users, was even more striking, surging to more than 14.11 million units with a year-on-year increase of 59.4 percent.

This rapid installation of home-based units signals rising consumer confidence and the normalization of EV ownership across suburban landscapes, as well as the significant grid modernization required to handle widespread residential charging demand.

According to the NEA, aided by improved charging services, motorists are choosing EVs for long-distance journeys, including the world's largest annual human migration, the Spring Festival travel rush, as well as the National Day holiday in October.

During this year's National Day holiday, the average daily charging volume grew by a substantial 45.7 percent compared to the same holiday period last year, proving the viability of NEVs for extended travel.

To sustain this momentum and prepare for an even larger national fleet, the government has launched a three-year action plan (2025-27), aiming to double the country's charging service capacity by the end of 2027 by constructing 28 million new charging facilities nationwide.

The nationwide charging network is projected to deliver over 300 million kilowatts of capacity by 2027 to meet the charging needs of more than 80 million EVs, according to a document recently released by six government departments, including the National Development and Reform Commission.

To meet these targets, Beijing intends to strengthen urban fast-charging capacity across a wide range of parking venues. The roadmap envisions the rollout of 1.6 million direct current terminals in cities by 2027, including a subset of 100,000 high-power units.

The strategy also prioritizes the modernization of highway networks, mandating the installation or renovation of 40,000 fast chargers in service areas, each with a minimum power output of 60 kW.

Zhou Libo, deputy secretary-general of the China Electricity Council's electric transportation and energy storage branch, said the country has already built the world's largest charging network in terms of coverage after years of efforts.

Zhou expects the NEV and charging/battery swapping sectors to maintain rapid growth during the 15th Five-Year Plan period (2026-30).

He called for scientific planning and moderate construction charging facility growth ahead of demand to meet the upsurge.

This strategic plan emphasizes not only sheer volume, but also quality and geographic equity, specifically aiming to eliminate infrastructure gaps in critical areas, he said.

This includes enhancing charging access along high-speed highways, upgrading facilities within older residential communities, and ensuring adequate coverage in smaller third and fourth-tier cities.

Two staff members conduct an inspection of charging piles in Fuzhou, Fujian province, in April. XIE GUIMING/FOR CHINA DAILY

According to the NEA, the rapid expansion and modernization of the charging network have been overwhelmingly driven by the private sector, which the central government has consistently encouraged to invest in major energy projects.

It highlighted the key role played by private enterprises, which reduce the dependency on government funding and enable a more agile, market-driven approach to development.

As of end-September, private companies demonstrated market dominance, accounting for eight out of the top 10 charging operators nationwide, it said.

These eight private enterprises collectively operate a commanding 70.7 percent share of all public charging piles. This level of private participation is indicative of the robust, market-led nature of the infrastructure build-out.

The involvement of the private sector extends across the entire operational scale. Previous data indicated that private companies accounted for over 80 percent of large-scale operators — those managing more than 10,000 charging facilities — contributing significantly to the establishment of a reliable network.

This robust competition fosters technological innovation and helps drive down operational costs, benefiting the end consumer, said the NEA.

China's EV charging infrastructure has also been attracting massive and continuous investment from both domestic energy conglomerates and major international players, solidifying its status as a critical global investment hub.

This dual influx of capital and technology is essential for building the world's most extensive and technologically advanced charging network, supporting the shift away from fossil fuels.

Power battery giant Contemporary Amperex Technology Co Ltd has partnered with China Petroleum and Chemical Corp (Sinopec), China's largest gas station operator, to rapidly expand the country's battery swapping network.

Under the agreement, the two parties plan to build at least 500 battery swap stations this year, and aim to increase the number to 10,000 in the future, while also working on establishing a unified national standard for battery swapping facilities as well as jointly managing and operating related assets.

State-owned Sinopec has about 30,000 gas stations and more than 10,000 electric vehicle charging stations nationwide, as well as 28,000 gas stand convenience stores, serving more than 20 million customers per day.

Foreign giants are also making deep commitments to the Chinese market, recognizing its unparalleled growth and innovation speed.

London-based Shell has identified China as one of its most crucial growth markets for electric mobility, with over half of its global EV charging terminals now located in China.

Selda Gunsel, chief technology officer of Shell, said previously that China has been a leading market in the field of EV charging, with as many as 40,000 of the company's 70,000 global charging piles located in the country.

Shell will continue to leverage its extensive global retail and mobility services network to support Chinese EV manufacturers in their international expansion efforts, said Gunsel.

Beyond sheer numbers, technological innovation is reshaping the user experience and grid interaction, moving the system toward intelligent operation.

Significant breakthroughs have been achieved in smart charging technology, with vehicle-to-grid interaction effectively "breaking the deadlock".

V2G allows EVs to not only draw power, but also feed power back during peak times, transforming the vehicles into mobile energy storage units that can significantly enhance overall grid stability and efficiency.

Experts believe the next major frontier for electric mobility in China is the vast rural market, where government incentives are accelerating the switch from traditional internal combustion engines.

Rural regions are poised to provide a major new source of growth for what is already the world's largest EV market, as NEV sales in smaller counties and towns still lag behind first-tier cities, said Liu Yongdong, deputy secretary-general of the China Electricity Council.

The policy focus is strategically shifting to unlock this vast untapped market potential, he said.

According to Liu, over the past five years, the charging infrastructure has rapidly extended into third and fourth-tier cities, and along highways and into rural townships.

Liu added that the 15th Five-Year Plan period is the critical phase for accelerating the construction of the charging infrastructure network system and the breakthrough period for achieving large-scale V2G application.

The council estimates that the charging network will be further expanded and upgraded, with the basic completion of charging networks in cities and metropolitan areas, and by rapidly addressing charging infrastructure deficiencies in rural regions.